How to Create Your First Amazon Seller Account

You’ve

done all the brainstorming, market research, and ordering of your new

products. You’ve even got a fancy business plan. Since you’ve decided

that opening a Fulfillment by Amazon (FBA) business is right for you, now you’re probably wondering how to set up your store so you can begin selling your products.

It might seem a little intimidating to set up your Amazon Seller account, especially if this is your first online retail business. Luckily, it’s really simple, and as long as you’ve got all the pieces in place, you’ll be selling in no time.

It’s important to take the time to prepare your store for customers, but once your account is all set up, you can add your inventory and get your store up and running!

Before diving into the step-by-step process of setting up your Amazon Seller account and your Seller Central space, there are a few things you need to have completed ahead of time to make sure the setup process goes as smoothly as possible:

- Figuring out what you’re selling and how you’re sourcing your product are the most time-consuming parts of setting up your FBA business. Make sure you’ve already done these tasks before you go through the effort of setting up your account so you can start selling right away. If you haven’t done this step yet, make sure you do your research on what products will help you excel as an Amazon Seller.

- Besides knowing what product you’re selling, you should probably decide on the name of your store before you create your account. Are you going to use your individual name, or do you have a business or brand name already decided on?

- Most importantly, you need to know if you’re going to be creating the account as a business (also known as an LLC) or as an individual (sole proprietor). Amazon has two different account options for sellers depending on their situation, but you’ll also need to have this decision made ahead of time for tax purposes, since you’ll need to fill out tax forms while setting up your account. (Yay, taxes!)

Once you have these things squared away, you’ll have all the key background information that will help you set up your store in a super-streamlined fashion.

Deciding your business structure: Sole proprietor or LLC

You’ll face an important question that will dictate how your business runs and operates right from the start: would you want to run your business under your ownership as a sole proprietor or as an LLC (Limited Liability Company)?

If you are unsure your commitment to a large FBA business and experimenting with growing your business, a sole proprietorship or operating as an “individual” on Amazon (we’ll get into that in the next section) may grab your attention. But, it does come with a catch.

As a sole proprietor you’ll have unlimited liability, meaning all assets and debts are owned by you. This puts you at risk because you will be directly liable in the case of any legal action taken against your business. If you owe debt larger than your business assets, you could lose personal assets to pay that debt.

In the case of an LLC, you would be protected as your business is an established entity that can be held liable in the case of legal action. With an LLC, business and personal assets are separate.

So why would anyone set up a sole proprietorship you ask? It’s the easiest and cheapest way to become one of Amazon’s sellers. You don’t have to go through the hassle of registering the business and establishing business income like with an LLC. Establishing an LLC generally costs more, and on Amazon it also means you will be responsible for business fees. Those fees would be nested under the Amazon Professional Seller Central account, which you would likely choose that option if creating an LLC.

Choosing an LLC or sole proprietorship will determine your next crossroads when creating your Amazon seller’s account. Will you go with an individual or professional account under Amazon Seller Central?

Your Choice: Professional or Individual?

It might sound like a no-brainer question (“Of course I’m a professional!”), but these are Amazon’s choices for your seller account plan. It’s worth exploring your options before you start the process of creating your account, since there are pretty big differences between the two.

Either way, you’ll be able to sell your items and run your FBA business; the major difference has to do with whether you think you’ll be selling more or less than 40 items per month (and whether you want to pay a monthly fee).

The Individual seller plan doesn’t have a monthly fee, and this plan is pretty appealing if you’re just starting out and in a more experimental mode with your products.

If you’re feeling pretty confident that your item’s going to sell like hotcakes, however, it might be worth it to pay $39.99 per month to be a Professional seller. That way, you won’t have to pay Amazon $0.99 for each item sold, which is the fee that Individual sellers have to pay.

If you want to wait and see how your FBA does, you can start as an Individual and upgrade your account to the Professional selling plan at any time. There’s a lot of overlap between the two plans: Both Individuals and Professionals have to pay shipping, referral, and closing fees, all explained on Amazon’s website. And both Professional and Individual sellers can list their products in more than 20 categories, but Professional sellers can include their products in 10 extra categories.

Whichever plan you choose, the process of creating your Seller account is exactly the same.

Getting Started: Create Your Amazon Seller Account

Before jumping onto Amazon’s website in the exciting rush to open your new FBA business, make sure you have these essential items right next to you: 1) a credit card that can be charged internationally, 2) your banking information, such as your routing and account numbers, and 3) your tax identification information, either for yourself or your business.

Once you’ve got these details, you’ll want to make your way to Amazon’s home page. Scroll to the bottom of the page and find the list titled “Make Money with Us.” Then, click on “Sell on Amazon.” It’ll take you to a page that looks like this:

Hope you’re ready to start selling, because that’s the button you need to click to start the process! Now you’ll enter the “Seller Central” side of Amazon. (*cue the oohs and ahhs*)

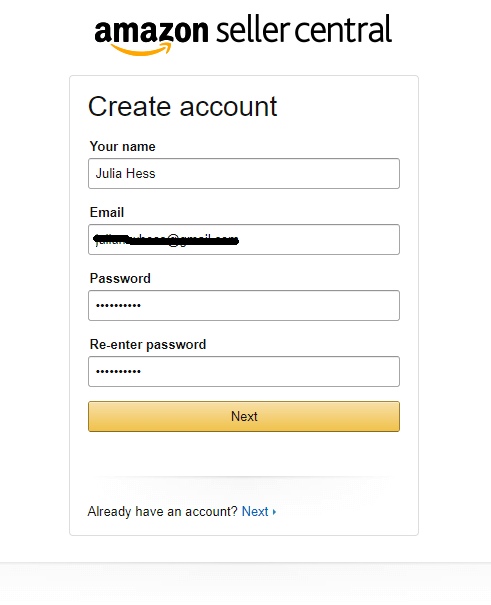

Next, you’ll need to create an account. Or, if you’re one of 65 million people who’s already an Amazon Prime member, log in to your account using the link below the form.

If you’re someone who likes to separate business and personal emails, you may want to use a different email than the one associated with your Amazon Prime account. Since you’re setting up your FBA business using this login, you’ll start getting emails about your orders and other business transactions. One thing to note is that for every Seller Central account you open, it must have a unique email attached. So if you are excited about starting FBA businesses and thinking ahead to selling your business with us, all of your accounts must have separate emails.

If you don’t already have a business email and you’d prefer to keep things separate, it’s simple enough to set up a Gmail account just for your business before you log on to Amazon.

Once you’ve created your account or logged on with an existing account, you’ll be asked to enter your legal name. Think of it this way: who’s paying the taxes for this business?

If you’re setting up your Seller account as an individual, use your name and tax identification information. Otherwise, stick with your business’s name and information.

Once you’ve entered this information, Amazon will ask for your business’s address. This is also the page where you’ll enter the unique display name for your business that everyone on Amazon will see. Amazon lets you know if the name has already been taken — I got lucky with the name and phone number for my fake business, as you can see below:

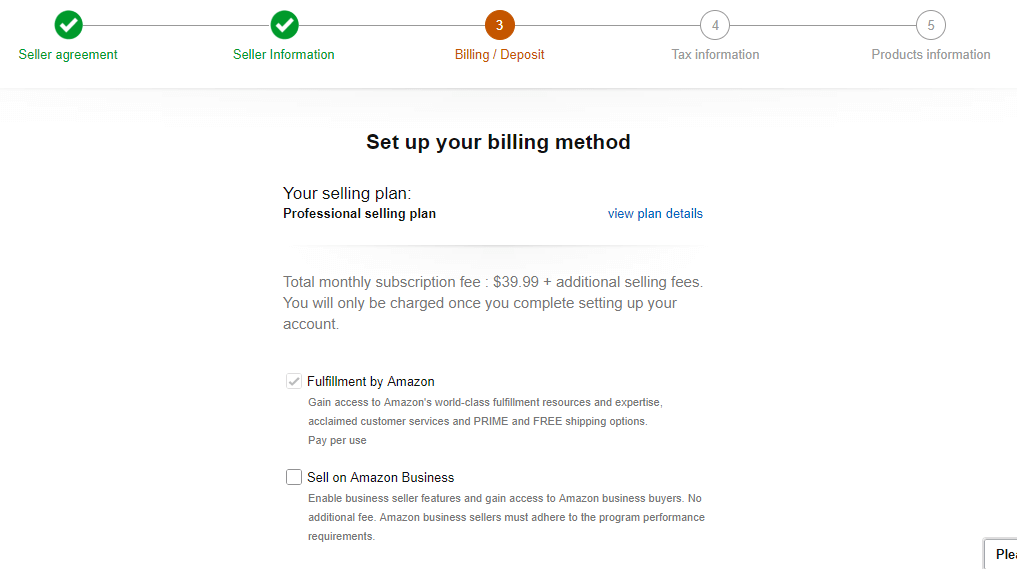

Amazon will then ask for a billing method, so you’ll need to whip out that internationally recognized credit card and banking information.

Once you’re on this screen, they’ll verify the selling plan that you chose. You’ll see here that I selected a Professional selling plan. Since you’re setting up a FBA account, make sure to check the box!

One of the last steps in this setup process is entering your tax identification information in a “tax interview” process. Essentially, Amazon needs to register you in their system, because they have to keep track of all the third-party sellers that they cut checks to. (And the lovely people at the IRS demand this information, of course.) As a mandatory step in this process, you’re basically filling out a W-9 form.

During

the tax interview, you’ll have to select whether you’re a sole

proprietor or a business. The major difference (besides all the

nitty-gritty details in the paperwork about taxes) will be that sole

proprietors/individuals will use their Social Security Number instead of

an Employer Identification Number as their tax identification number.

Amazon validates and provides you with a W-9 form pretty quickly after you’ve submitted your information. Yay, technology!

The last step in setting up your Seller account is providing general information about your products, but this is optional — you can skip it and fill it out at a later time.

After these five steps are complete, your Seller account is all set up. Now the fun really starts — it’s time to explore Seller Central.

Setting Up Your Seller Central Space

Seller Central is the space that Amazon provides for you to set up your FBA business, manage inventory and orders, and so much more. You can reach Seller Central by going to sellercentral.amazon.com and logging into your account.

Once you start exploring Seller Central, you’ll discover that it’s pretty user-friendly. Start by exploring the different drop-down lists on the upper left side — Inventory, Orders, Advertising, Reports, and Performance — to familiarize yourself with what these areas look like.

If you check out the drop-down list for “Inventory,” you’ll see “Manage FBA Inventory.” As an FBA business, you’ll become pretty familiar with this page, full of your Amazon-fulfilled inventory.

When you’re ready to enter your first product, you can select “Add Product” from the “Inventory” drop-down list and follow the steps.

Under “Advertising,” Amazon provides you with ideas on how to reach your audience. Below, you’ll see that they’re suggesting my store Beach Bum Accessories should participate in the Early Reviewer Program, where I would send my products to someone and they would provide me with a review based on their experience. (While there are many ways to market your products, like through a Pay Per Click campaign, this is definitely one that will help boost your public image in a more authentic way.)

Performance will probably be one of your most-utilized subsections, and for good reason. Amazon provides you with an Account Health Dashboard that breaks down customer service, product compliance, and shipping performance, letting you see how your business is doing in a more detailed way (rather than basing performance solely on sales).

After exploring the major parts of Seller Central, it’s time to finalize a few details to get your FBA business ready to sell some products. Seller Central is your domain, so it’s helpful to set it up with certain administrative preferences before adding inventory to your store.

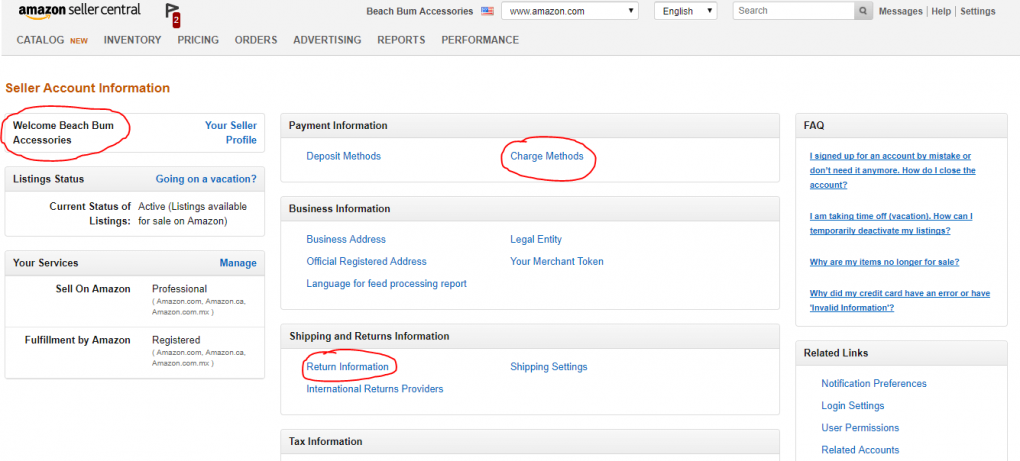

First, double-check that all of your information is correct, such as your business’s name, the billing information, and the return method. To find this page, click on “Settings” in the top right corner, and from the drop-down list, select “Account Info.”

The items circled in red are the places you’ll want to double-check, just to make sure all of the information is correct. If you changed your mind about your business name, here’s your chance to edit it. If you want to add another charge method or need to make sure you put your information in correctly, click on “Charge Methods.” And for “Return Information,” you’ll want to verify that the address of the return location is where you want it to be; if there are any issues with your product, people will need your return information, but it better be returned to the correct place!

On the Seller Account Information page, you can also change your email preferences, check your tax information, update your business address or legal entity, and essentially make any changes you’d like on the administrative side.

After checking all this information, return to the Settings drop-down list and select “Your Information & Policies.” It’s time to tell the world who your business is and what you’re all about!

Select “About Seller” to provide a brief description of who you are or a blurb about your company — this will be what your customers read when deciding whether or not to buy from you. You can also add your company’s logo, as well as your privacy policy and FAQs.

One of the most important items on the Settings drop-down menu is “Fulfillment by Amazon” — since, you know, your whole business model is based on the Amazon FBA concept.

On the Fulfillment by Amazon Settings page, you’ll find a whole lot of sections. Take time to peruse through each of the subsections to learn all about the optional settings, inbound settings, repackaging, and multi-channel fulfillment, to name a few.

It’s especially important to take note of the Repackaging Settings and the Automated Unfulfillable Removal Settings to make sure they’re set to your preferred setting — these will affect the inventory you have and how quickly you can move new inventory, too.

Set up, Sell, Scale: Follow the Steps to FBA Success

Whether you’re selling as a sole proprietor with an individual account, or a professional business owner with an LLC, this guide can help with getting your business set up and ready to make money. You can’t scale your business until it’s selling products, and you can’t sell products until your FBA business is set up properly.

Seller Central may appear complicated on the outside, but never fear — Amazon also makes it easy for new sellers to navigate the space with an extra-thorough “Help” section. Plus, there’s a lot to learn and experiment with in terms of figuring out the best set-up for your situation, so take your time.

If you want to future-proof your business, you can start thinking about how to build a brand on Amazon. Amazon is unrolling new social media tools like Amazon Posts and brand-building platforms like Amazon A+ content to make your business stand out on the marketplace.

And of course, if you want to get a head start, you can always buy an Amazon FBA business from our marketplace that is already making money month-in and month-out. If that is something more appealing to you then starting from scratch, then schedule a criteria discovery call with our team and we’ll help match you up with a business that makes sense for your current skill level.

It’s appropriate time to make plans for the future and it is time to be happy. I have read this post and if I could I wish to suggest you few interesting things or advice. Perhaps you could write next articles referring to this article. I desire to read even more things about it!

ReplyDeletewhat is an amazon fba business